Our team of CLO analysts work around the clock, improving data and extraction models in Semeris Docs for CLOs. Working with investors over the past year has allowed us to extend and refine our growing collection of relevant topics of interest in CLO documents. Tailor your own summary view of the document and the transaction as you see fit by selecting from our available topics repository.

Capturing deal complexity with hierarchical data

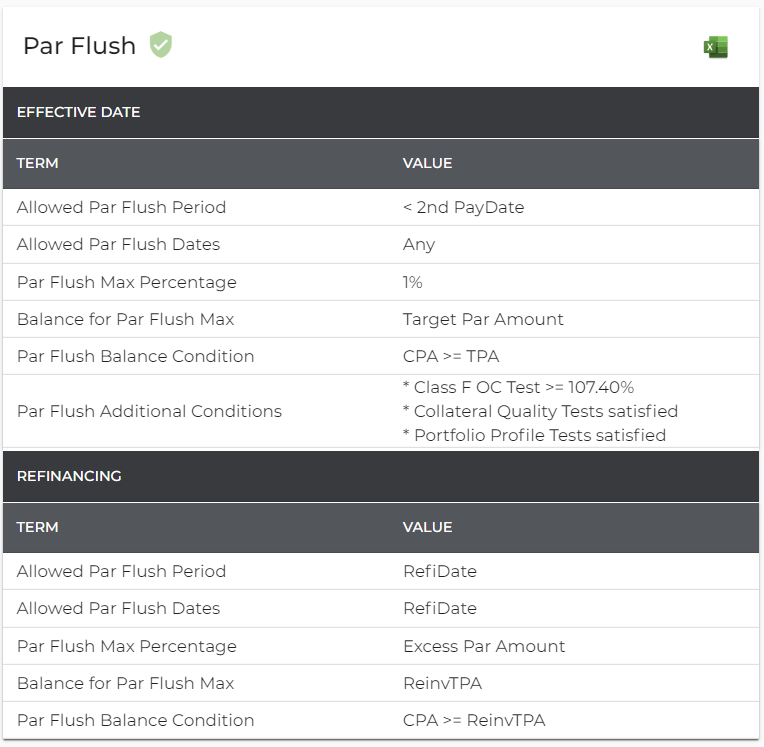

Other solutions, especially those configured for multiple document formats might try to present extracted information in a flat question/answer structure. However, this may fail to capture important nuances specific to certain deals - e.g. different clauses for different periods during the deal life-cycle. For example, different Par Flush mechanisms apply in different time periods, and the definition of these periods might vary from deal to deal. Our solution is specifically designed with CLO investors and deal documents in mind, and knowing the details brings these nuances to light.

Analyst-verified information

Our cloud-delivered system provides 250-300+ different analyst-verified data points (depending on the complexity of the deal) organized in their relevant categories, such as:

- Cap Structure

- CCC Excess

- Dates

- Discount Obligation

- Documents

- Entities

- ESG

- Fees

- Frequency Switch

- IC/OC Tests

- Identifiers

- Loss Mitigation Obligations

- Most Junior OC

- Optional Redemption

- Par Flush

- Personnel

- Portfolio Profile Tests

- Rating Agencies

- Reinvestment Criteria

- Retention Notes

- Trading Gains

- Voting

- etc.

Analyst-recommended topics for deal summaries

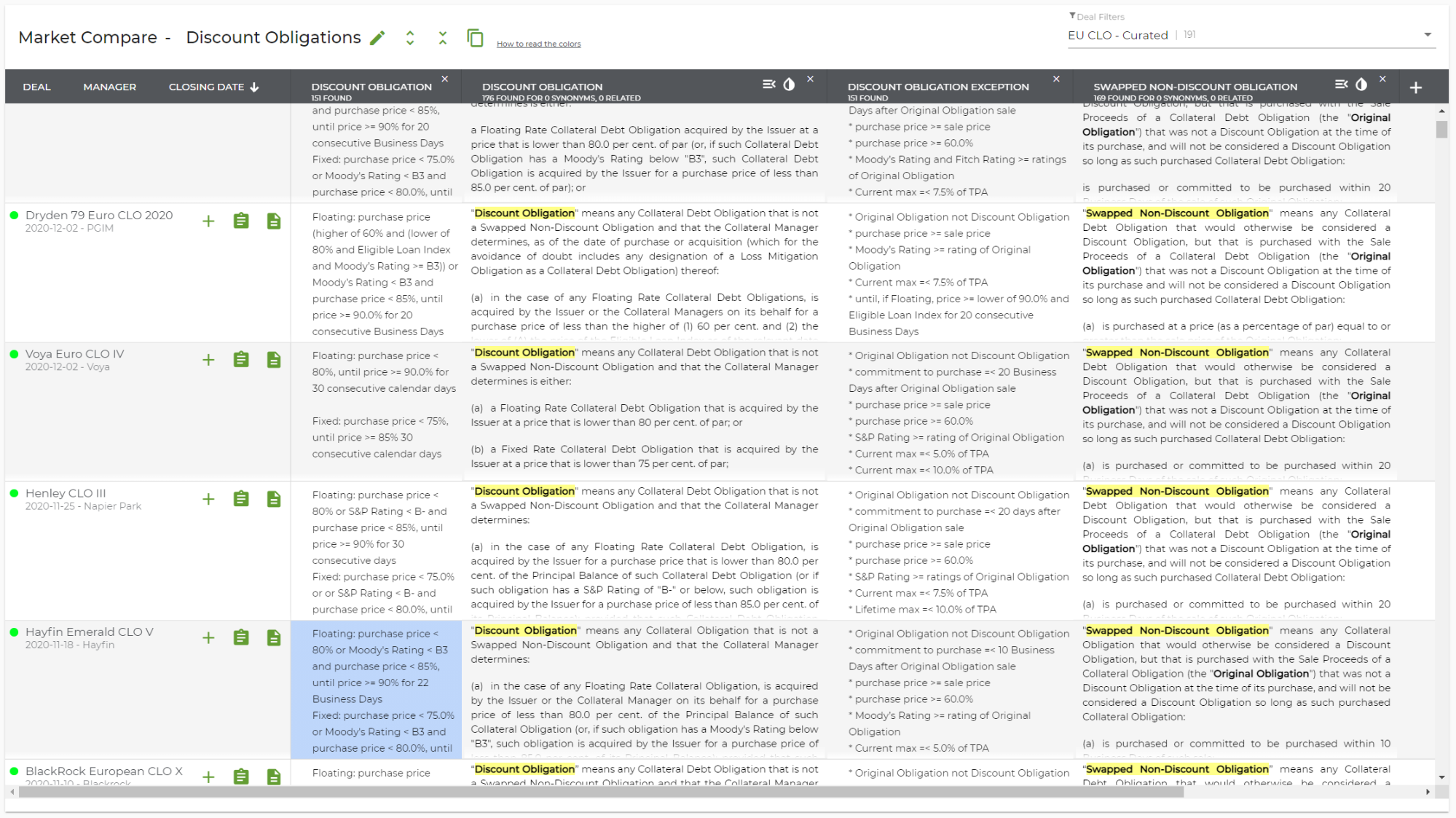

Because a simple list of summary questions cannot correctly represent evolving deals, our solution also includes automated language extractions and pre-built topics recommended by our analysts, such as:

- CCC Haircut

- CLO Manager Advances

- Concentration Limitations

- Cov-Lite

- Coverage Tests

- Dates

- Discount Obligations

- Discretionary Sales

- Eligibility Criteria

- Entity Details

- LIBOR Replacement

- Modification and Waiver

- Non-Euro Risk

- Obligation Maturity Amendment

- Reinvestment Criteria

- Retention

- Target Par Amount

- Trading gains

- WAL

- WARF

- Workout Loan

- and more

Example-driven language extractions include:

- Additional Issuance

- CLO Manager Advances

- Coverage Test Start

- Discretionary Sales

- Eligibility Criteria

- Events of Default

- Minimum Purchase Price

- Modification and Waiver

- Negative Cash Balances

- Note Repurchase

- Obligation Maturity Amendment

- Optional Redemption Conditions

- Refinancing Spread Not Wider

- Reinvestment Criteria

- Supplemental Reserve or Collateral Enhancement Account

- and more

Use our data in your in-house systems

Everything you see in Semeris Docs can be exported to Excel for further analysis.

This includes both structured data and extracted contract language.

If you are interested in Semeris Docs for CLOs, contact our team for further details and demonstration.