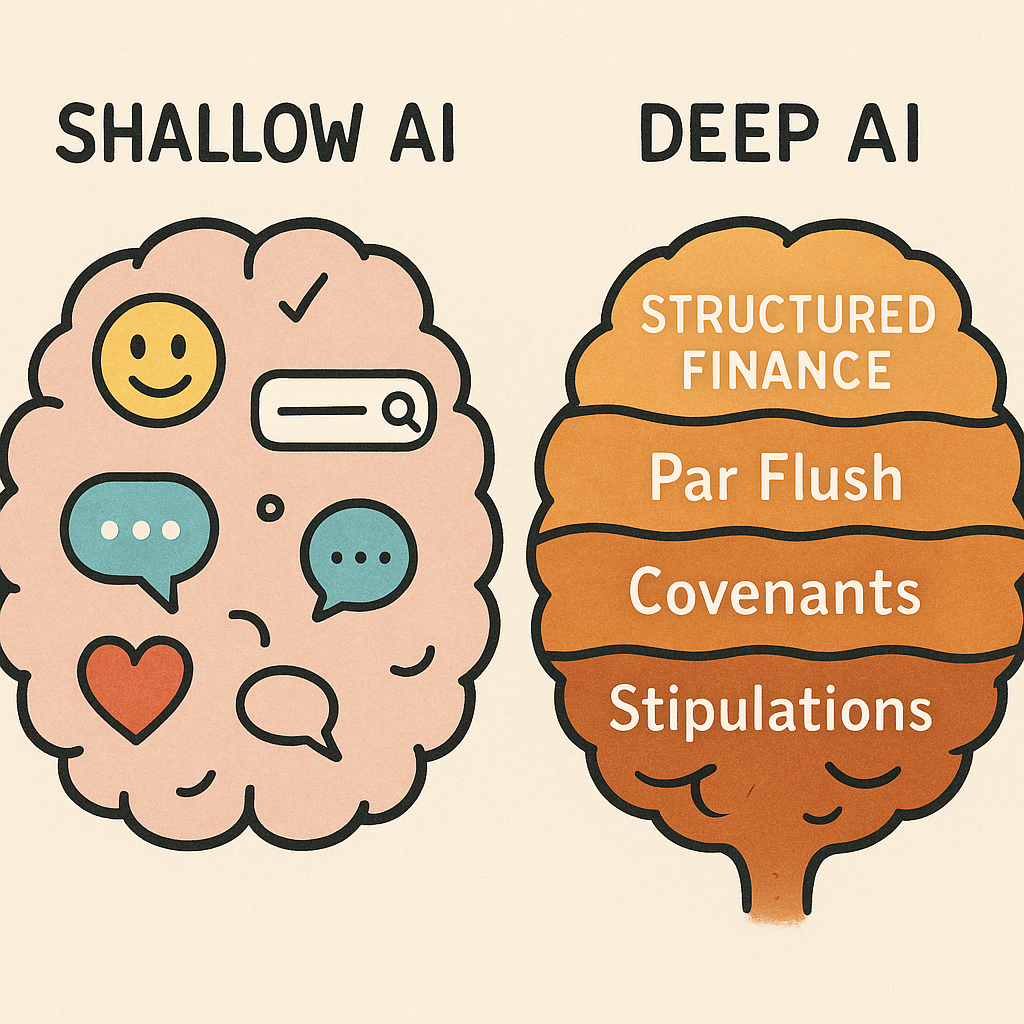

In the AI landscape, a critical distinction exists between broad, general-purpose systems and specialized, domain-specific solutions. This distinction isn't merely academic—it directly impacts productivity and accuracy of financial professionals navigating complex documentation in structured finance markets. When millions of dollars and compliance requirements hang in the balance, the limitations of shallow AI transform from inconvenience to liability.

ChatGPT's popularity has pushed conversational AI mainstream and prompted financial institutions to explore its potential. Yet in specialized domains like CLOs and structured finance, depth trumps breadth. Streamlined processes outperform conversational exploration, and subject matter expertise supersedes generic intelligence.

The truth remains: professionals don't need “one size fits all” AI that tries to answer everything—they need AI tailored to their use case that answers their specific questions precisely.

The Chat Paradox: Why Conversational Interfaces Fail in High-Stakes Finance

At Semeris, we've built and used chat interfaces internally for over two years. While our team uses conversational AI daily, we've excluded these interfaces from our customer-facing Semeris Docs platform for a simple reason: they reduce efficiency on critical tasks.

The pattern from our software development team is revealing. Our junior team members embrace conversational coding AI enthusiastically, while senior engineers report more errors, overlooked edge cases, and minimal time savings. For many complex tasks, current AI implementations actually reduce productivity.

The challenge is clear: CLO professionals need tools that comprehend not just financial terminology, but the specific conventions and practices governing their domain.

Dialogue Without Depth: What Do You Mean by "Par Flush"?

General-purpose AI systems are technological marvels, but their breadth sacrifices crucial subject expertise. For specialists, this manifests in daily frustrations:

- Initial Promise vs. Daily Reality: General AI impresses with versatility in demos and basic queries, but falters with nuanced language of credit agreements and indentures—precisely when specialists need it most.

- The Expertise Gap: When queried about specialized CLO concepts like "par flush rules" or "reinvestment criteria," general AI lacks foundational knowledge for reliable answers. "Par flush" as a concept might exist in training data, but not how it's implemented in confidential documents. You should find “Par Coverage Ratio” even if you ask for "Overcollateralization Ratio", by identifying defined term synonyms. This gap forces professionals to constantly verify and correct generalized systems, creating more work rather than reducing it.

- Time Drain vs. Savings: This verification burden is critical. One structured credit desk head noted: “We spend more time checking the AI’s work than doing the analysis ourselves. The efficiency isn’t there for our specialized needs.” Generalized AI might work — if you're willing to moonlight as a coach, painstakingly training it in the specifics of your domain.

- Eroding Trust: Without domain expertise, general AI produces inconsistent results across similar provisions, undermining confidence and requiring constant human supervision.

Despite chat interface hype, our work with CLO professionals shows high-performance analytical workflows rarely align with the conversational model:

- Dialogue Limitations: Chat interfaces excel at exploration but create bottlenecks when retrieving standardized information across multiple documents.

- Scale Inefficiency: Comparing provisions across deals through conversations becomes prohibitively time-consuming.

- Reusability Challenge: Analysts shouldn’t repeat the same conversation for each new document. Time-sensitive analysis requires instantly applying predefined extractions across document sets.

Chat interfaces have their place—our analysts use them to create new data points or handle unique inquiries. However, for quick insights, analysts need immediate access to high-quality predefined data points rather than ongoing conversations.

Semeris: Subject Matter Expertise and Purpose-Built Tools

Semeris has developed a fundamentally different approach to AI for structured finance—built on deep domain knowledge:

- 400+ Analyst Verified Data Points: Our system comes pre-loaded with analyst-verified structured data points for CLO document analysis. These high-quality extractions can flow directly into your calculations without additional verification, eliminating the trust gap of general AI systems.

- Terminology Foundation: Our analysts have taught our system the language patterns of CLO documentation. For example, this knowledge enables our Stip Tracker to map your “world” into Semeris data points. When you add a new stipulation, our system has likely encountered similar patterns before, improving accuracy.

- Specialized Interfaces: We’ve created targeted user interfaces for different analytical needs:

- Semeris X-Ray document viewer for efficiently reading complex legal text,

- Smart Blacklines that instantly identify changes between document versions,

- Market comparison tools to visualize data and defined term variations across deals,

- Term Explorer to quickly find new terms, synonyms, or rarely used terms in new deals, and more.

This approach recognizes a key truth: different analytical tasks need different interaction models, and chat is just one tool among many.

The Path Forward: From Shallow Conversations to Deep Domain Solutions

The gap between shallow, general AI and deep, domain-specific solutions directly impacts your team's productivity, accuracy, and confidence. Financial professionals should evaluate AI not by breadth of capabilities, but by how precisely it serves their specialized needs. The most valuable AI isn't the most conversational—it's the one delivering immediate, trustworthy insights for your domain. At Semeris, we prioritize depth where it matters.

The structured finance market moves too fast and carries too much risk for approximations and educated guesses. While others chase the latest conversational AI trends, we're solving the real problem: giving CLO professionals tools that match their expertise, not their patience. When your next deal closes on schedule because your AI actually understood the indenture language, you'll know the difference between depth and breadth isn't just technical—it's a competitive advantage.